Understanding Forex Trading: A Comprehensive Overview

Forex trading, commonly referred to as foreign exchange trading, is the process of exchanging one currency for another in the global market. This financial market is decentralized, meaning that it operates without a central exchange or physical location. Forex trading is essential for international business and investment as it enables the conversion of currencies worldwide. The market is known for its high liquidity, diverse trading options, and the potential for substantial profits. If you’re looking to dive into this exciting world, you might find the forex trading definition Best Platforms for Trading useful as you start your journey.

What is Forex Trading?

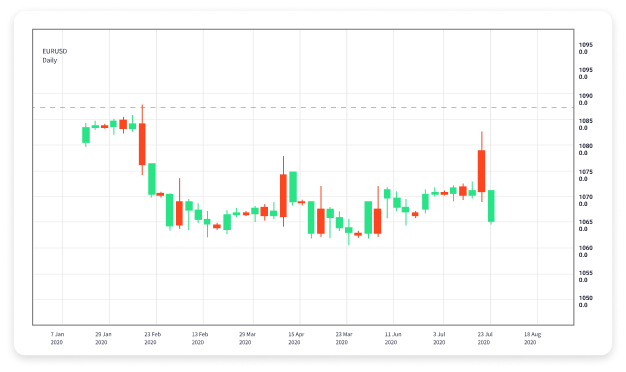

At its core, Forex trading involves the buying and selling of currency pairs. Each currency in a pair represents a trade; one currency is bought while the other is sold. For example, if a trader believes that the Euro will strengthen against the US Dollar, they may buy the EUR/USD pair. If their prediction is correct and the Euro gains strength, they can sell the pair for a profit. The Forex market operates 24 hours a day, five days a week, allowing traders from all corners of the globe to participate at their convenience.

The Mechanics of Forex Trading

In Forex trading, currency pairs are categorized into three types: major, minor, and exotic pairs. Major pairs are the most traded, including EUR/USD, USD/JPY, and GBP/USD. Minor pairs do not involve the US Dollar and include currency pairs like EUR/GBP and AUD/NZD. Exotic pairs, on the other hand, comprise one major currency and one from a developing economy, such as USD/TRY (Turkish Lira).

The prices in Forex trading are determined by supply and demand, geopolitical events, economic indicators, interest rates, and other factors. Traders utilize various tools and analysis methods, including technical and fundamental analysis, to make informed trading decisions. Understanding how these elements influence currency values is crucial for successful trading.

Benefits of Forex Trading

There are several advantages to trading in the Forex market. One significant benefit is the high liquidity, which allows traders to enter and exit positions with ease and minimal price slippage. The market’s 24-hour nature means traders can react swiftly to news and events that impact currency valuations, providing opportunities for profit at any time.

Additionally, traders can use leverage, which allows them to control a more substantial position with a smaller amount of capital. This can magnify gains but also increases the risk of losses, making it essential to manage risk effectively.

Risks Involved in Forex Trading

While Forex trading offers potential profit opportunities, it also carries inherent risks. Market volatility can lead to significant price swings, resulting in substantial losses. Moreover, the use of leverage can amplify both profits and losses, leading to a heightened risk-reward balance.

Traders should employ risk management strategies, such as setting stop-loss orders and using position sizing techniques, to mitigate potential losses. Education and experience are vital to navigating the Forex market effectively, as understanding market dynamics can significantly influence trading outcomes.

How to Get Started in Forex Trading

For those interested in exploring Forex trading, the first step involves educating oneself about the market’s mechanics. Many online resources, courses, and books cover various aspects of Forex trading, providing a solid foundation for beginners.

Next, prospective traders should choose a reliable Forex broker that offers a trading platform tailored to their needs. Look for brokers that provide a demo account, allowing you to practice trading with virtual money before risking real capital.

Creating a trading plan is also crucial. This plan should outline your trading goals, risk tolerance, and specific strategies you plan to employ. A well-structured trading plan will help you maintain discipline and make informed decisions consistent with your objectives.

Conclusion

In summary, Forex trading is a dynamic and potentially profitable market that involves buying and selling currency pairs. Understanding the mechanics, benefits, and risks involved is essential for anyone looking to participate in this global market. With the right education, tools, and strategies, traders can navigate the complexities of Forex trading and work towards achieving their financial goals. As you embark on this journey, remember to continuously learn and adapt to the ever-evolving landscape of the Forex market.